How To Get Rid Of Debt Fast

Life is unpredictable. Sometimes something can put us in debt for various reasons that we could not expect. Debt is a natural thing, but it becomes unnatural if the existing debt is left alone so it makes the existing interest even greater. If you are already in this condition, you must have many questions, such as how to get rid of debt fast.

To meet their daily needs and start a business, not a few people choose to go into debt and pay it gradually so that the financial flow becomes smoother.

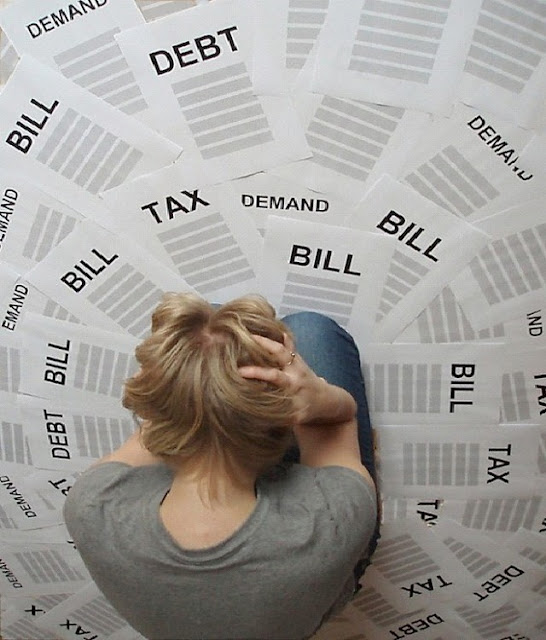

|

| (Photo: baklol.com) |

However, there are also some people who when they have debt, want to pay it off directly or do not want to be bound by debt for a long period.

How To Get Out Of Credit Debt Fast

Looking for ways to pay off debt quickly must be done if you have a loan. Because if you are already in debt, your life may not be peaceful.

By looking at the amount of debt that is already too much, of course you start thinking about how to immediately pay off the debt.

Is there a way to pay off debt quickly? Of course, there is a way, as long as you are also firmly committed to making changes in your life.

There are several ways to get rid of debt quickly, including:

1. Make a Debt List

The first way to pay off the debt that must be done is to make a list of all the debts you have. Record the amount of debt, interest rates, and payment deadlines.

This is done so that later it is easy to track and manage payment priorities.

2. Create a Realistic and Detailed Budget

Next, you need to make a breakdown of your expenses and monthly. From this stage, you can identify expenses that can be reduced or the remaining amount of money to pay the debt.

3. Start with the Biggest Flowers

If you have some debt, you can start paying it down by prioritizing the debt with the highest interest rate. So that the amount of interest you have to pay in the long run will decrease.

4. Start with the Smallest Amount

In addition to prioritizing debt with high-interest rates, you can also start by paying off debts that have the smallest amount. Paying down small debts first will motivate you to pay off larger debts.

5. Look for Additional Income

Try to find additional sources of income, such as side jobs outside of the main job. The money from a side job that you get can be used to pay off debts faster.

6. Stop Shopping Using Credit Cards

Don't use a credit card while you're still trying to pay off debt! Avoiding the use of credit cards will help you control spending.

7. Sell Items That Can Be Sold

Try to look at the things you have. Is there anything unused or unneeded? If possible, sell the items you have to pay off debts.

Examples of items that can be sold quickly are electronics or jewelry from gold. The item can be sold to get additional money that can be used to pay off debt.

8. Learn a Frugal Lifestyle

You are required to save money if you want to be free from debt. Consider cutting back on eating out or looking for cheaper entertainment alternatives. The funds you save will then be used to pay off debts.

9. Reduce Non-Important Expenses

Evaluate monthly expenses and look for ways to reduce non-essential expenses.

10. Discipline in Paying

The next quick way to pay off debt is to make debt repayment a top priority. Don't let you pay late. Because you can get additional fines or penalties as a penalty for delay.

11. Negotiate with Debtors

If you face serious financial difficulties, don't hesitate to negotiate with the debtor or the person whose money you borrowed.

Talk honestly about your financial situation and see if there are other payment options. At least show that you have good faith to pay off debts.

12. Don't Add Debt

Avoid adding new debt during the debt pay-off process! Focus on paying off existing debt before considering new debt.

13. Find the Support of People Closest to You

Paying off accumulated debt is not easy. Usually, people who are in debt will experience stress. If left unchecked, the person can experience severe depression.

Therefore, you need support from the closest people. Seek support from family or friends. They can provide moral support and advice on financial problems that you are experiencing.

14. Be Patient with Circumstances

Paying off debt takes time and patience. Sometimes there are many challenges along the way. It could be that you will be tempted to buy luxury items that you don't need at all.

Remember that in every payment you make, you are clearing existing debts.

15. Learn Good Financial Management

You need to start learning how to manage good finances to avoid debt in the future. Learning about financial management will keep you from falling into the same pit.

There are many financial management learning resources around you, ranging from the internet, and books, to direct experts. You can adjust the knowledge learned to your current financial situation.

That's a bit of information about "how to get rid of debt fast". Hopefully, this information is useful and a reference for those of you who want to get out of debt quickly.

0 Response to "How To Get Rid Of Debt Fast"

Post a Comment