Small Business Loan Calculator

Having a small business by what is dreamed of is a matter of pride, especially if the business is already running and can also meet the needs of life. However, even though the business is already running, there are times when you want to develop the business, increase the number of goods sold, or expand the business by opening branches. If capital becomes an obstacle, currently many financial institutions will finance, but what must be considered is to know how much is needed and must be paid using a small business loan calculator.

|

| (Photo: biz2credit.com) |

The presence of loans for small businesses is certainly very helpful for novice business people and small business people to develop their businesses. And this will be very helpful, starting from operations, emergency fund needs, additional capital, and so on.

Small Business Loan Payment Calculator

Taking a loan from a bank can be a solution for business owners when they want to develop their business.

Many things must be done when you want to develop a business and also cooperate with other parties, such as financial institutions and banks to develop a business.

One that must be considered is to understand the calculation of loan interest. Currently, there are many applications and also various tools provided by loan providers to calculate loans from principal and interest that must be paid each month. The tool provided is called the "Business Loan Payment Calculator".

Currently, you do not need to manually calculate how much loan must be paid each month, because there are many tools available on the internet such as shopify.com, which provides free tools "Business Loan Calculator", an easy way to calculate the monthly payment of your business loan.

Taking out a small business loan will help start or grow your business, but it's important to know what you're getting into before borrowing money.

A small business loan calculator like the one presented above will give you an idea of how much it costs to take out a loan. Also, adjust the timeframe and add extra monthly payments to see how much impact you can have on payments.

Small Business Loan Rate Calculator

Still taking information from shopify.com, by using shopify.com's free Business Loan Calculator, you will be able to track the actual cost and budget of your loan to grow your business.

Determine your return amount, total cost, and annual percentage rate (APR).

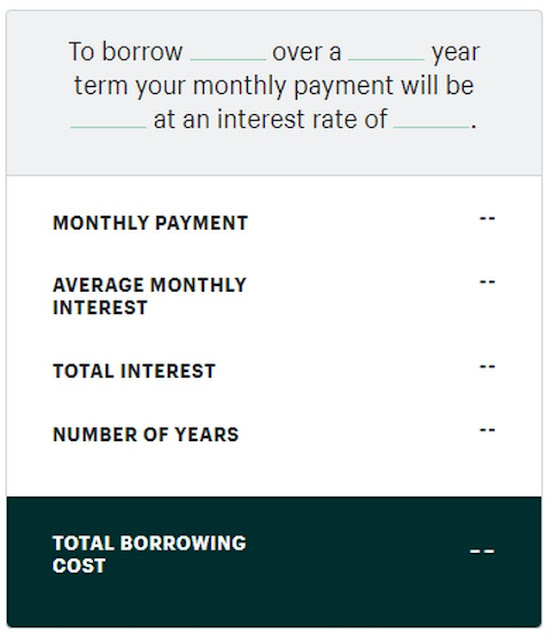

To use the Business Loan Calculator, follow these steps:

|

| (Photo: shopify.com) |

- Enter Your Information: Start by entering the necessary information into the calculator. This includes the loan amount, annual interest rate, and loan term. If you make additional monthly payments beyond the threshold, you can enter them in the optional field.

- Calculate Result: After you enter the required information, click Calculate. The Business Loan Calculator will process the data and generate results based on your input.

Some relevant terms:

|

| (Photo: shopify.com) |

- Monthly Payments: This figure is the minimum amount you must pay each month to adhere to the loan repayment schedule. This includes the principal amount of the loan (initial) and accrued interest.

- Average Monthly Interest: Average monthly interest is the average amount of additional charges on the initial loan amount you agree to pay per month over the life of the loan.

- Total Interest: This value represents the additional cost you will pay beyond the initial amount you borrowed.

- Number of Years: The number of years refers to the term of the loan. It shows the time at which you are expected to make the payment.

That's a bit of information about the "small business loan calculator". Hope the information is useful.

0 Response to "Small Business Loan Calculator"

Post a Comment