How Can I Consolidate My Debt

Who doesn't want to be free from debt bondage? Of course, everyone wants to be able to get out of debt. However, many of them do not want to sacrifice and are committed to paying their debts, so they eventually accumulate. Of course, being able to escape the debt trap is an extraordinary thing. Many experiences on how to get rid of debt, including steps taken to reduce debt, and questions about "How Can I Consolidate My Debt" as a solution to be able to settle the debt.

|

| Illustrative image (Picture: homebasemortgages.ca) |

It can be admitted that having a lot of debt certainly makes our lives uncomfortable. Debt also often works like a virus. In fact, after going into debt for one errand, there will be other attractive offers to owe back.

How To Consolidate My Debt

There are so many ways to be able to settle debt, of course, all have choices and all have their ways, including when you choose debt consolidation as the chosen way.

If the reason is because of difficulties in managing several debts that have different maturity dates, then you can choose the debt consolidation method.

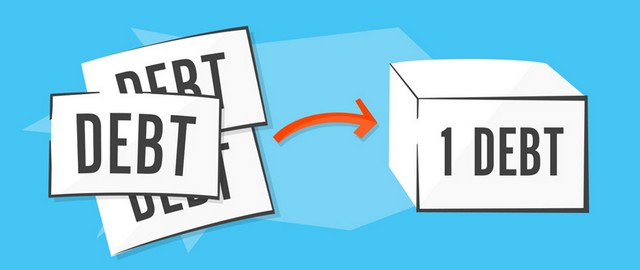

Debt consolidation is a debt repayment technique that is done by creditors who will pay off all your debts and will unite everything into one debt.

So, you only have to focus on paying one person or company. Usually, this debt consolidation provides higher interest than general debt interest. But with this, you can avoid charges due to late or missed debt payments so you can save more money.

The debt consolidation method is suitable for people who can be disciplined not to use credit cards or owe again before paying off existing debts.

There are also ways to consolidate debt that can be done are:

1. Create a Healthy Financial Lifestyle

Know whether your finances are healthy by knowing the size of all loans the amount of monthly payments, then how long the loan will expire. Record all loans that must be repaid with their respective details.

In this way, it will make it easier to manage payment transactions at once, then it will be known whether this debt can be consolidated or not.

2. Comparing Total Debt to Income

After taking the first step, and the results have been obtained, write down how much income you have each month. Then start calculating, what percentage of income must be paid debt and also calculate the amount of all interest from your debts.

If the funds are leftover and enough to meet the needs of a month of life and also offer interest that is smaller than the accumulated debt interest, then consolidating debt can be chosen.

3. Choosing the Best Bank

Each bank offers different interest rates depending on the products offered and also the terms and conditions that apply. Compare interest rates from several banks that you trust, and if necessary get comparison information online on the website of each bank.

After getting a bank that offers low-interest rates, don't forget to consider the issue of convenience and flexibility of loan payments.

Debt Consolidation Is Not a Debt-Free Solution

Combining several debts and making them one debt, or consolidating this is not a solution to be debt-free.

However, at least this consolidation opens a gap for those of you who are dizzy thinking about how to pay off debt, to gradually start to be able to pay off the debt. Keep adjusting existing income to the amount of debt, because adding debt usually adds new problems, so calculate it in detail.

That's a little information about "How Can I Consolidate My Debt". Hope it is useful.

0 Response to "How Can I Consolidate My Debt"

Post a Comment